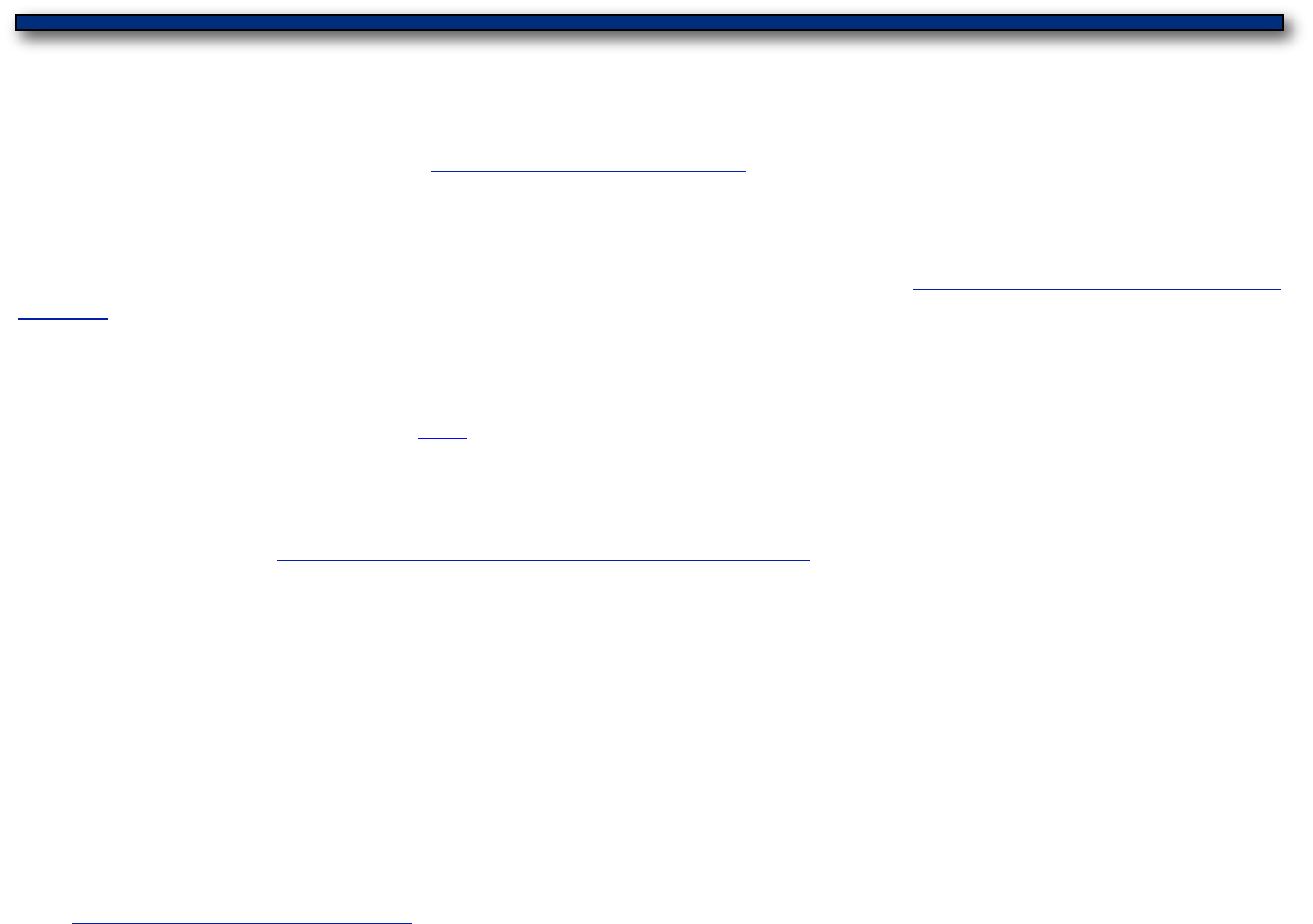

Day 13 to 33 (7 days before first

date set for Meeting of Creditors):

deadline to provide tax returns to

trustee

(see page 5)

DISCHARGE

Day 1:

File bankruptcy petition with

court and pay filing fees

(see page 2)

Day 20 to 40

Meeting of Creditors -

also called 341(a) Meeting

(see page 7)

Day 80 to 100

(60 days

after first date set for Meeting of Creditors):

deadline to complete financial

management training course and file

Form 423

(see page 9)

GRANTED

(see page 11)

1

10

20

30

40

50

60

70

80

90

100

Before filing bankruptcy

(within 180 days before filing):

complete credit counseling

course

(see page 1)

Day 20 to 30

(30 days

after filing OR on or before first date set for

Meeting of Creditors, whichever comes first):

deadline to file statement of intention (if

not already filed with petition on

Day 1)

(see page 6)

Day 50 to 70

(30 days

Day 80 to 100 (up to 60 days

after first date set for meeting of creditors):

reaffirmation agreements

(see page 10)

Day 1 to 14:

File certificate of credit counseling, lists,

schedules, statements & payment advices (if

not already filed with petition on Day 1)

(see pages 3 & 4)

after fi

rst date set for Meeting of Creditors):

Deadline to perform Statement of Intention

(see page 8)

CHAPTER 7 BANKRUPTCY TIMELINE

Updated 5/15/2018

Page 1

Before filing bankruptcy (within 180 days before filing): complete credit counseling course

Description

Before you file for bankruptcy, you must complete a credit counseling course from an approved credit counseling

agency. These courses generally last 60 to 90 minutes, and may be completed in person, on the internet, or over the

phone. For a list of approved credit counseling agencies, you may visit www.justice.gov/ust/eo/bapcpa/ccde/

cc_approved.htm.

Upon completion of the course, you will receive a Certificate of Credit Counseling.

Deadline

You may complete the credit counseling course any time within 180 days before you file for bankruptcy.

Page 2

Day 1: File bankruptcy petition with court & pay filing fees

Description

Filing a bankruptcy petition is your official request to the court to open your bankruptcy case. You can find the

bankruptcy petition package online at www.cacb.uscourts.gov/forms.

The “bankruptcy petition package” refers to the

entire set of court documents required to open a bankruptcy case.

For assistance in completing the bankruptcy petition package, you can visit the Self-Help Desk at your divisional

courthouse.* Hours and information for each Self-Help Desk are available at www.cacb.uscourts.gov/dont-have-

attorney under the “Free or Low Cost Bankruptcy Help” tab.

Once you complete your petition package, you can file it by bringing it to the intake window of the clerk’s office at

your divisional courthouse. At the time of filing, you will have to pay a filing fee. Bankruptcy fees are listed on the

Court's website and may be accessed here.

If you have trouble paying the filing fee, the court may grant you permission to pay in installments. If your income is

below 150% of the poverty level and you are unable to pay the fees even in installments, the court may waive the fee

requirement. Please see www.uscourts.gov/FederalCourts/Bankruptcy.aspx

for more information.

Deadline

You must file your bankruptcy petition package within 180 days after completing your credit counseling course.

*Visit www.cacb.uscourts.gov/court-locator and type your zip code into the search bar on the left to find your divisional courthouse.

Page 3

Day 1 to 14: File Certificate of Credit Counseling

Description

You must file the Certificate of Credit Counseling that you received upon completion of the credit counseling course.

Deadline

You may file the Certificate of Credit Counseling with your bankruptcy petition package on Day 1.The absolute

deadline to file the certificate is 14 days after filing your petition.

Page 4

Day 1 to 14: File lists, schedules, statements & payment advices

Description

There are a number of court documents included in your bankruptcy petition package, including the Schedules of

Assets and Liabilities, Schedule of Income and Expenditures, and Statement of Financial Affairs.

Deadline

You may file these documents with your bankruptcy petition package on Day 1.The absolute deadline to file these

documents is 14 days after filing your petition.

Page 5

Day 13 to 33 (7 days before Meeting of Creditors): deadline to provide tax returns to trustee

Description

You are required to provide a copy of your most recent federal tax return to your Chapter 7 Trustee.* Your

Chapter 7 Trustee’s address will be listed in a notice entitled, “Notice of Chapter 7 Bankruptcy Case, Meeting of

Creditors, Deadlines” which you will receive from the court after filing your bankruptcy petition.

Deadline

You are required to provide your tax return to your Trustee at least 7 days before the first date set for your

Meeting of Creditors (See Page 7).

*In a Chapter 7 bankruptcy case, you may hear the word “Trustee” more than once. The Office of the U.S. Trustee is part of the

Justice Department, responsible for protecting the integrity of the Federal bankruptcy system. After you file your Chapter 7

bankruptcy, the Office of the U.S. Trustee will appoint a Chapter 7 Trustee to oversee your case. The Chapter 7 Trustee is a

private, impartial individual paid to administer your bankruptcy and liquidate any non-exempt assets in your estate.

Page 6

Day 20 to 30 (30 days after filing OR on or before first date set for Meeting of Creditors, whichever comes

first): deadline to file Statement of Intention

Description

The Statement of Intention is a document in the bankruptcy petition package that addresses your secured debts --

these are debts in which there is collateral (property) promised to your creditors in case you fail to pay them back.

Examples of secured debts include car loans and mortgages. In the Statement of Intention, you will describe your plan to

either surrender or retain any property securing your debts.

Deadline

You can file the Statement of Intention with your bankruptcy petition package on Day 1. The absolute deadline to file

the Statement of Intention is within 30 days after filing your petition OR on or before the first date set for the Meeting

of Creditors (whichever comes first).

Page 7

Day 20 to 40: Meeting of Creditors - also called 341(a) Meeting

Description

Once you file your bankruptcy petition, the court will mail you and any creditors a notice entitled,“Notice of Chapter 7

Bankruptcy Case, Meeting of Creditors, Deadlines.” This notice informs your creditors of your bankruptcy case,

provides information about various court deadlines, and contains the date, time, and location of the Meeting of

Creditors.

The Meeting of Creditors is not a court hearing, but rather a chance for the Chapter 7 Trustee overseeing your

bankruptcy case, as well as any creditors who wish to attend, to ask you questions regarding your financial affairs and

property. Although there will be no judge present during the Meeting of Creditors, you will be under oath as you

answer questions regarding your financial situation.

You must bring to the meeting:

•

photo identification

•

your Social Security card

•

documentation supporting the schedules from your bankruptcy petition

Deadline

The Meeting of Creditors takes place within 20 to 40 days after you file your petition.

Page 8

Day 50 to 70 (30 days after first date set for Meeting of Creditors): deadline to perform Statement of

Intention

Description

As you recall, you were required to file a Statement of Intention with the court, describing your plan to either

surrender or retain any property securing your debts (See Page 6).

Deadline

30 days after the first date set for the Meeting of Creditors, you must perform what is outlined in your Statement of

Intention.

Page 9

Day 80 to 100 (60 Days after First Date Set for Meeting of Creditors): deadline to complete financial

management course and file Form 423

Description

In addition to the credit counseling course you completed before filing for bankruptcy, you are ALSO required to take a

financial management course from an approved agency.The course can be completed in person, on the internet, or over

the phone. For a complete list of approved agencies where you can take the course, please visit www.justice.gov/ust/eo/

bapcpa/ccde/de_approved.htm.

Once you complete the financial management course, you will receive a Certificate of Completion.

You are not

required to file the Certificate of Completion itself, but you must complete Official Form 423

(“Certification About a Financial Management Course”) and file this with the court

-- unless the

approved agency through which you took the course has already notified the court of the your completion.

Deadline

You must file Official Form 423 within 60 days of the first date set for your Meeting of Creditors.

Page 10

Day 80 to 100 (up to 60 days after first date set for meeting of creditors): reaffirmation agreements

Description

If you wish to keep certain personal property after filing for bankruptcy, you may enter into a Reaffirmation Agreement

with your creditor. In a Reaffirmation Agreement, you agree to continue making payments on a particular debt (such as a

car loan) in order to keep the property (such as a car).

If you are represented by an attorney during the negotiation of a Reaffirmation Agreement, and your attorney signs all

the appropriate sections of the agreement, it is not necessary for a judge to approve the agreement.

However, if you are not represented by an attorney during the negotiation of a Reaffirmation Agreement, you must

attend a court hearing called a Reaffirmation Hearing, where the judge must review and approve the Reaffirmation

Agreement.The judge must decide that the agreement is in your best interest in order to approve it.

Deadline

You must file the Reaffirmation Agreement within 60 days after the first date set for Meeting of Creditors.

Page 11

Discharge Granted

Description

Congratulations! The discharge is the order from the court forgiving you from certain debts. Once your discharge is

granted, your creditors can no longer attempt to collect from you for the debts that were discharged. Remember, not all

debts are dischargeable in bankruptcy. Please see www.cacb.uscourts.gov/faqs

for more information.

Deadline

Discharges may be granted as early as 60 days after the first date set for the Meeting of Creditors. However, the timing

of a discharge varies from case to case.